Growth Guardian System –2024 Annual Update and December, 2024 Monthly Update

The Growth Guardian System (GGS) is designed to achieve consistent, long-term investment growth while minimizing losses during market downturns. This update reviews the GGS’s performance for December 2024 and for the entire year of 2024.

The Stock Market - 2024

US equities as represented by the S&P 500 had an up year overall in 2024 continuing a long uptrend. The total return of 23.31% marked a robust performance for the second consecutive year. AI enthusiasm was a strong driver and a surprisingly strong economy supported the rise as well. Two thirds of the companies in the index ended the year higher.

S&P 500 Index 2001-2024

The green circle in the lower left indicates the start of the GGS backtested results.

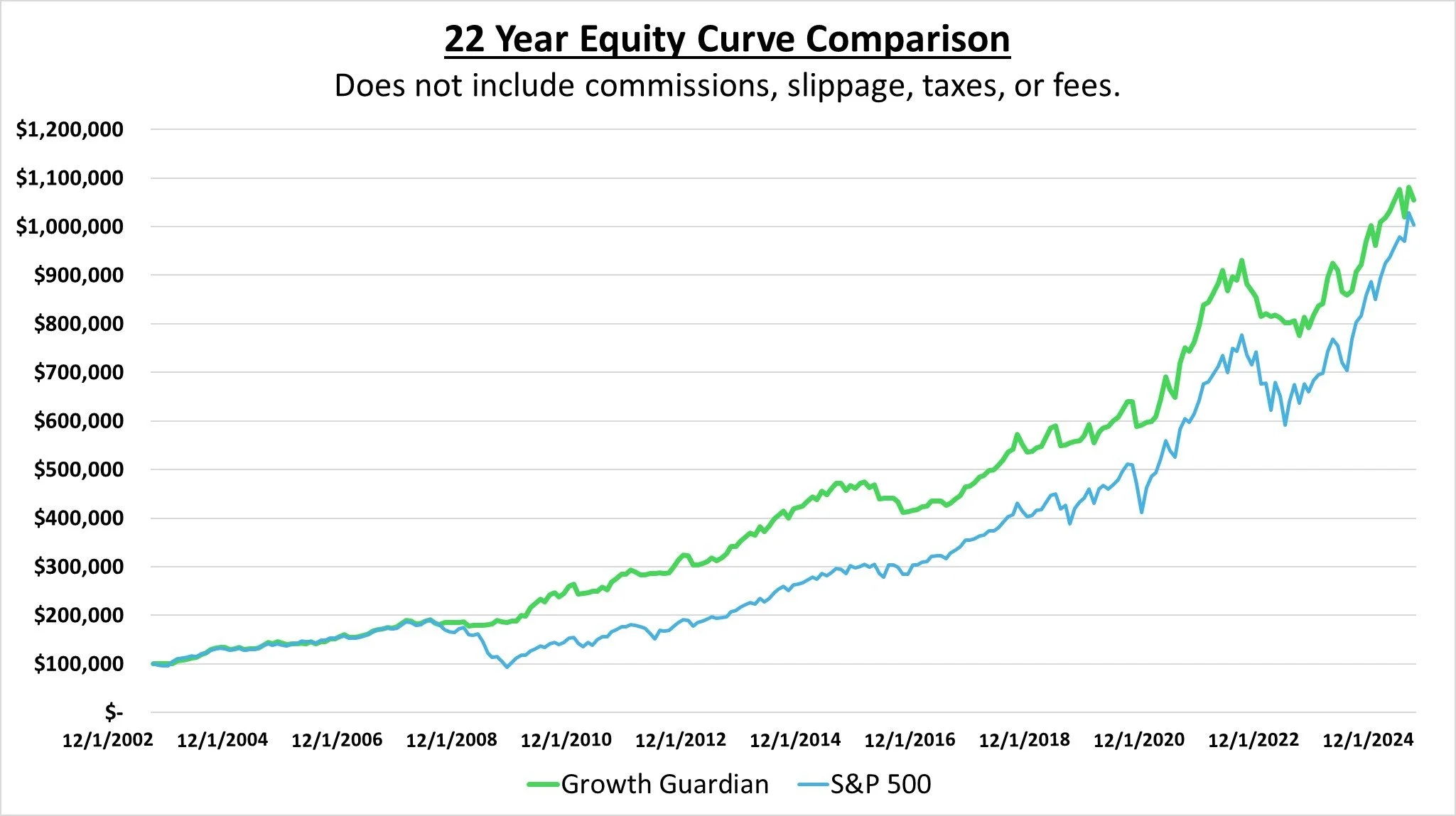

Growth Guardian System Performance 2003-2024

As you can see from the lines in the chart below, the GG System remains ahead of the S&P since the beginning of the test period in 2003.

While beating the S&P over the period is nice, that’s not the primary performance objective for the system. For more on that, see the next section.

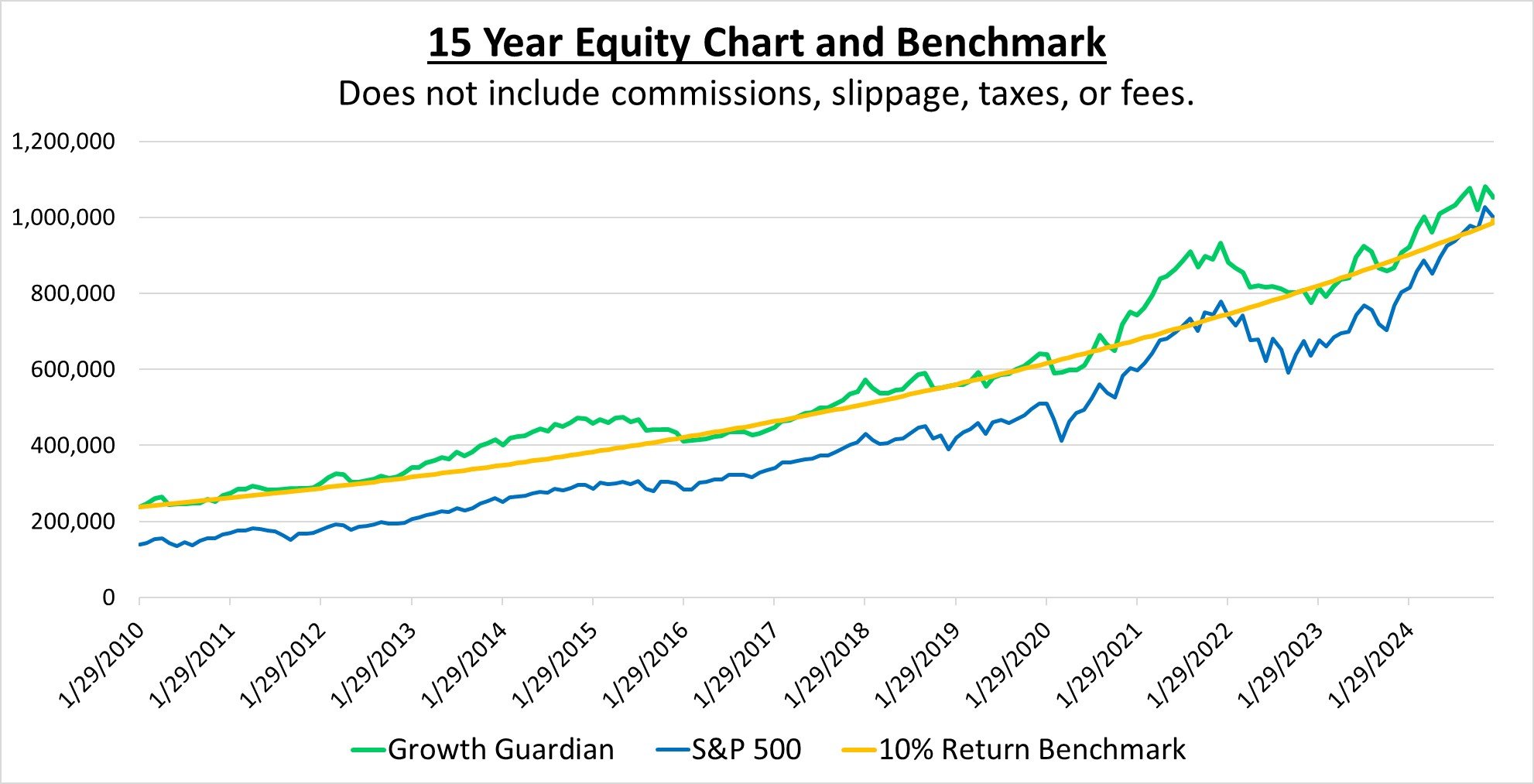

Long Term Key Metric

One of the system’s primary objectives is to achieve a 15-year annual growth rate of more than 10%. At that rate of return, an investor can double their starting equity in approximately seven years. The compound annual growth rate for the GG System has been 11.4% from 2003 to 2024. The chart below focuses on just the past 15 years. The smooth yellow curve represents a constant 10% return starting at the same equity as the system starting in 2010.

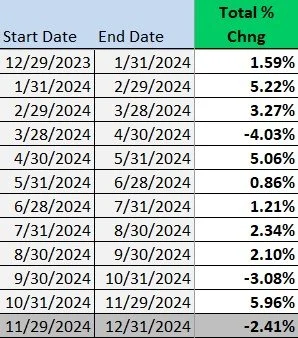

System Performance by Month in 2024 –

The system performed within its historical range last year. The three count for losing months aligned with the historical average of 30% losing months. The system finished the year with a 19.0% return.

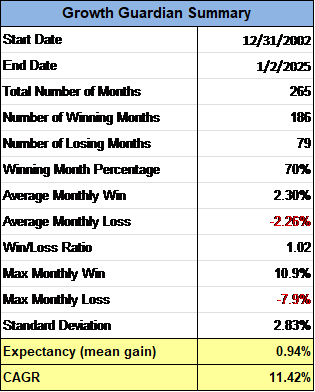

System Historical Performance

The following table shows a number of metrics for the system’s backtested performance since 2003 –

A Note on the GG System Performance

Since 2003, the Growth Guardian System has performed consistently because it shifts the account into higher-performing areas of the capital markets each month. To identify these areas, the system evaluates relative strength (which areas are performing better) and momentum (which areas are moving up faster). The areas considered include large-cap stocks, developed market large-cap stocks, small-cap stocks, and bonds. When none of these options look favorable, the system temporarily moves into cash. The system has undergone refinement and evolved through several generations over the past fifteen years and we will continue to evolve it.

Looking Ahead

What will 2025 bring? We don’t know. Be wary of anyone who tells you they do know. From a historical perspective, there have only been 9 occasions in the last century when the market experienced two or more consecutive years of 20%+ returns. When that has happened, the market return in the third year has been lower and sometimes it has been negative – with one notable exception. In the late 1990s, the market strung together 5 consecutive years of 20%+ returns. Are we in a 1990s market state again with AI as the driver now instead of .com Internet companies? Perhaps. Perhaps not. The market will let us know.

Regardless, investing with a strategy like the Growth Guardian System allows you to psychologically let the market do whatever it will because you know that the system will grow equity if the conditions are favorable and it will protect it if conditions are unfavorable.

Feedback Requested

Your feedback plays a pivotal role in shaping the future of this newsletter and the system. Thank you for your participation in the Founders Fifty group and for providing your feedback.

What did you like or not like?

What did we miss or not cover?

We appreciate any observations, questions, suggestions, and criticisms.

Thank you and be back with you next week with the system signal update on Friday, Jan. 31.

RJ

Note: This update underscores the importance of focusing on long-term goals rather than short-term market fluctuations. Staying disciplined and adhering to the system’s principles can help users achieve consistent growth over time. Past performance *

*Comprehensive Disclaimer for TenHundred Co.

TenHundred Co. is the publisher of the Growth Guardian Investment Letter and other publications.

TenHundred Co. is a trade name used by TenHundred Marketing Co., a corporation registered in the state of North Carolina, USA. Any references to "TenHundred Co." in this document or on our website is intended to denote the DBA (Doing Business As) name authorized. All contractual obligations, legal agreements, and official business operations are conducted under the registered name, TenHundred Marketing Co.

Educational Purpose Only: TenHundred Marketing Co. is a research provider offering material for educational and informational purposes only. No persons or entities involved in publishing this educational material are registered as an investment advisor, commodity trading advisor, or broker-dealer. We do not provide personalized financial advice. Our publications do not take into account your individual investment objectives, financial situation, or needs and is not intended to constitute recommendations tailored to your circumstances.

No Guarantees of Performance: Trading and investing in stocks, ETFs, or any other securities involve substantial risk and may not be suitable for all investors. Past performance of any strategies, systems, or methodologies mentioned in our publications is not necessarily indicative of future results. Hypothetical or simulated performance results have inherent limitations and no representation is being made that any account will achieve profits or losses similar to those discussed.

Risk of Loss: All investment strategies carry risk, including the potential for loss of principal. No investment strategy, system, or risk management technique can guarantee returns or eliminate risk in any market environment. ETF investments and trading strategies discussed in this publication may result in losses, including the possibility of loss of your entire investment.

Independent Decision-Making: Before acting on any information provided in our publications, readers should conduct their own research and carefully consider whether such investments or strategies are appropriate for their financial circumstances. Consult with a qualified financial, investment, or tax professional to assess the suitability of any strategy discussed.

No Fiduciary Responsibility: TenHundred Marketing Co. does not act as a fiduciary and is not subject to state or federal investment regulations. Neither TenHundred Marketing Co. nor any of its officers, employees, or contributors accepts liability for any direct, indirect, or consequential loss arising from reliance on the information provided.

No Offer or Solicitation: This publication is not a solicitation or offer to buy or sell securities, ETFs, or any other financial instruments. Any discussions of trades, investments, patterns, systems, or strategies are for illustrative and educational purposes only and should not be construed as advisory recommendations.

Hypothetical Performance Limitations: Any hypothetical, backtested, or forward-looking performance results presented in our publications are illustrative in nature and subject to numerous assumptions and risks. These results do not reflect actual investment results and may not be reflective of the results you achieve.

Transparency and Responsibility: TenHundred Marketing Co, its officers, employees, and partners may use the investment system in this newsletter and hold investment positions in the ETFs or securities discussed. TenHundred Marketing Co, its officers, employees, and partners may also hold investment positions outside of the newsletter system in the same ETFs or securities discussed in the newsletter and they may trade any of the investment positions without notice. Potential conflicts of interest will be disclosed when applicable.

No Explicit or Implicit Recommendation to Open an Account: This Letter does not recommend opening an account at any brokerage. If you choose to you open a brokerage account, you are responsible for performing your own due diligence.

By using the information provided in our publications, you agree to hold TenHundred Marketing Co. harmless from any claims or liabilities arising from its use. Investing is inherently risky.

You are responsible for your own financial decisions.