Smart Signal System Report: March 2025

I don't operate as a licensed financial professional and this information is presented for educational purposes only, not as a recommendation to buy or sell anything. You'll find my full disclosure statement at the bottom of this email. Consult with your professional team before making any investment decisions.

Note:

Two groups receive this report:

those who pay for the SmartSignal System service and

those subscribe to the free newsletter.

I send this report on the system performance to the free newsletter subscribers as an educational service. Readers can learn how a systematic approach works and determine if this system might interest them in the future. It discusses positions only generally and has no specific trade information.

System Update

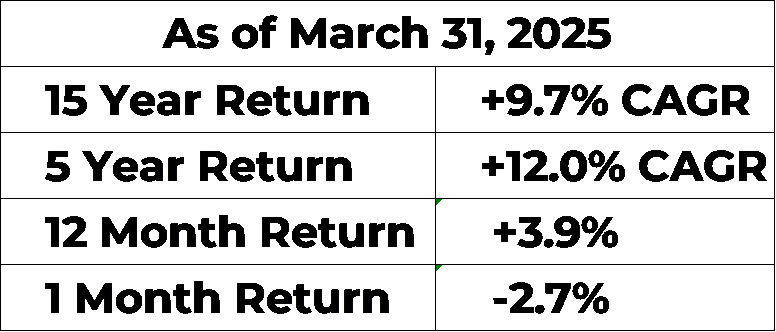

The system return numbers fluctuate month to month on the shorter time periods but longer term, the numbers tend to vary less.

In February, the system trimmed its US large cap investment position by 50% and then it fully exited the position in March. Proceeds from the first sale moved into developed countries’ large cap foreign equities because they showed nice upward momentum over the last 6-7 months while the US large caps (S&P 500) moved sideways.

Foreign equities stayed relatively flat in March though the system exited the position in early April. That exit happened because the US stock market dropped significantly. Such a massive down day often signals subsequent massive down days – those kind of big drops tend to cluster.

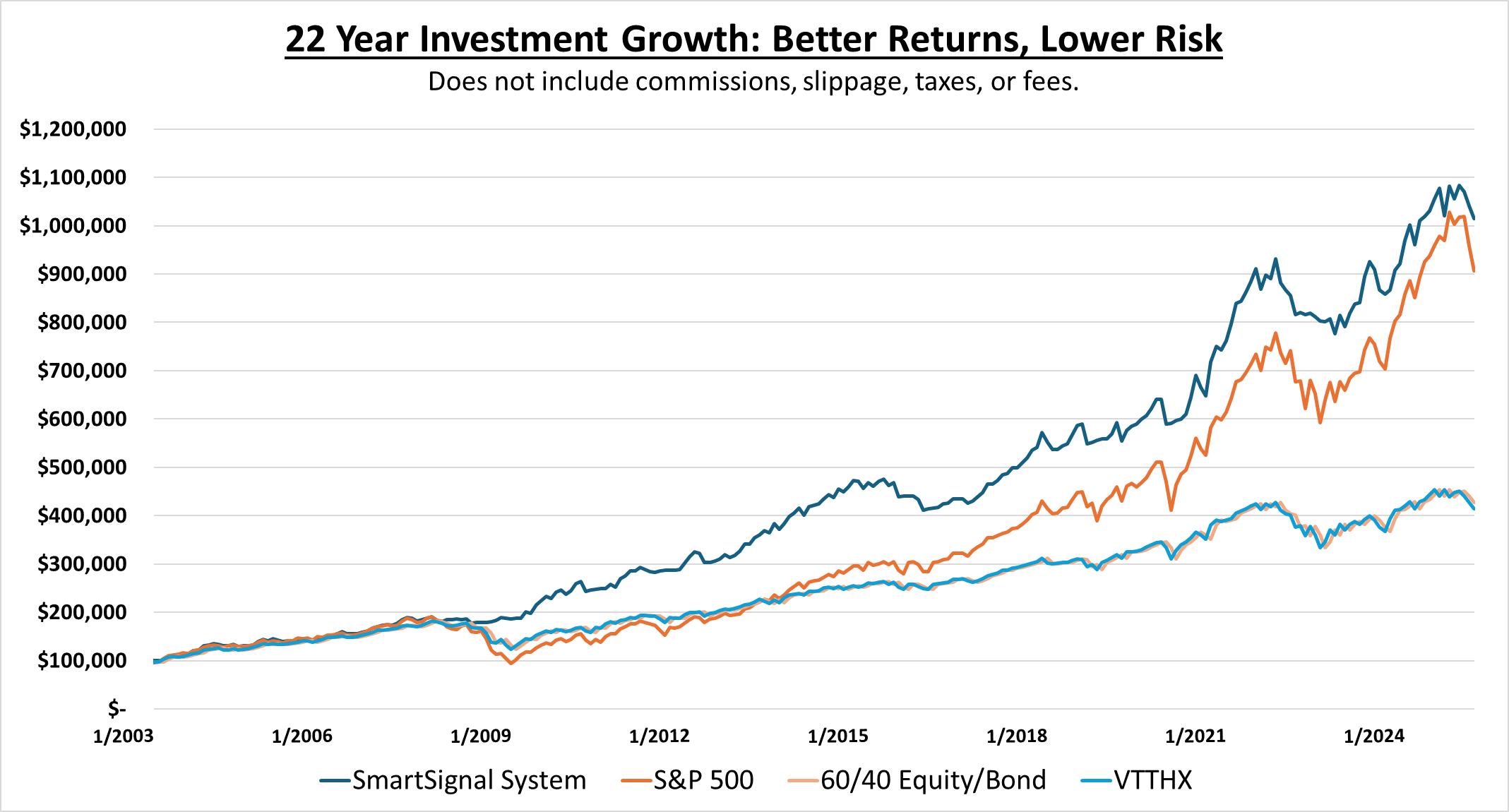

Since an end of the quarter just passed, let’s take a look at the long-term equity curve updated through April 17, 2025. You can see the drop in the SmartSignal line recently while the S&P line has dropped much more. The other two lines represent a 60/40 equities/bonds portfolio and VTTHX, which is Vanguard’s 2035 Target Date Retirement fund.*

Market Update

Looking at the 20-year S&P 500 chart below, you can see the notable drop over the past 8 weeks. The S&P peaked at 6,147 in mid-February (around the 19th) and has a net drop of about 14% on April 17.

The next chart demonstrates what volatility looks like. In the left side of the chart, we saw an orderly decline - the bars remained smaller without significant gaps between them. Once April begam, notice the huge gaps between some of the bars and the much taller bars. One hourly bar from April 9th covered almost 400 points (383 to be precise). One hour! Not so long ago, some years did not see the S&P climb as much as it did in an hour.

The primary market characteristic remains high volatility rather than having any clear direction yet. I've spoken with several former Van Tharp Institute clients who trade on a daily basis. Some of them report stepping back from trading due to prices moving too fast to get orders filled near the price they want.

The market dropped about 20% at its lowest but has recovered to about 14% down now.

Big Picture

Last month's report highlighted that the US stock market has reliably moved upward over the long-term. The critical challenge for Smart Signal System clients—and anyone midway or nearing the end of their career—is timeframe. You don't have 60-80 years to wait for buy-and-hold strategies to work; you need certainty that you can count on your investments to help cover expenses in retirement. Instead, your investment horizon might only be 10-30 years. During these shorter timeframes, the stock market can remain flat or even decline in real terms (after inflation) for more than a decade, making active management essential.

This reality requires a different approach for different life stages. Buy-and-hold strategies work well when you have decades ahead—ideal for investors in their twenties or thirties, or during sustained bull markets. For those approaching retirement who need access to their equity in about 20 years, hearing that markets rise over 50-80 year periods isn't particularly helpful. These shorter timeframes—especially during choppy, sideways, or declining market types—benefit more from active management to avoid large or lengthy drawdowns. This is the core concept of the book Bill (my systems collaborator) and I are writing. Importantly, active investment management does not necessarily require a finance degree or hours of daily attention. Following the SmartSignal System takes just a few minutes per month—the time it takes to enjoy one cup of coffee. The recent market shift over the past eight weeks suggests we've entered a new phase where relying solely on buy-and-hold strategies may be insufficient for maintaining equity levels.

In an interview a few months back, Stan Druckenmiller repeated the phrase "precariously perched" to describe the market levels at the time. Remember that? Well, the tariffs turmoil knocked the market off of its precarious perch. Fortunately, we have a system that responds dynamically to changing market conditions and explains why we now hold 100% cash (or a short-term bond ETFs). The market moved fast and the SmartSignal System adapted accordingly. While our system results show a short-term decline, the broader market has fallen much further.

Many attribute the market fall to Trump’s tariff policies. Ray Dalio, however, published an insightful article on LinkedIn last week emphasizing that tariffs represent but one symptom of a much larger shift. We face a breakdown in the current global economic power structure. The current unsustainable situation requires resolution but the tariffs represent "the tip of the spear" of a longer term process that will likely prove difficult. For a more complete picture of his country dominance model, see Dalio’s book The Changing World Order.

Rapid and big changes seem to be evident and maybe accelerating. Why does there seem to be so much that’s changing recently? Analyst Peter Zeihan noted that geopolitical stability often persists for decades with only minor shifts and conflicts – what he termed the "glacial phase." The world has been in a glacial phase since World War II. Then, everything changes over a short period, maybe a few years or 5-10 years. He calls this the "lightning phase". Recent events seem to confirm we are in the lightning phase.

What will markets do next? I don't know, and neither do the experts offering forecasts and predictions.

We don't need to know! We have a system that adapts to conditions; that takes market information inputs and provides actionable signals. Two key benefits of following such a system: freedom from concern about what the hyperventilating television pundits say and freedom from reacting emotionally. The system informs us of the soundest path forward based on what has worked best. For the moment, the best option is found on the sidelines.

If you have questions or want to discuss recent developments, please contact me at help”@”ggletter.com. Most of you have my phone number, feel free to text or call.

* Target date funds like VTTHX typically use variations on the 60% stocks and 40% bonds strategy. Generally, these funds start out in earlier years with a heavier weighting towards equities. As time gets closer to the target date, the weighting shifts more towards bonds. Marketing for these funds tends to focus more on their safety rather than their returns. I thought professional management and the shift in the fund’s holdings over time might show some difference with a straight 60/40 portfolio but apparently - not so much. More to research here.